idaho sales tax rate by county

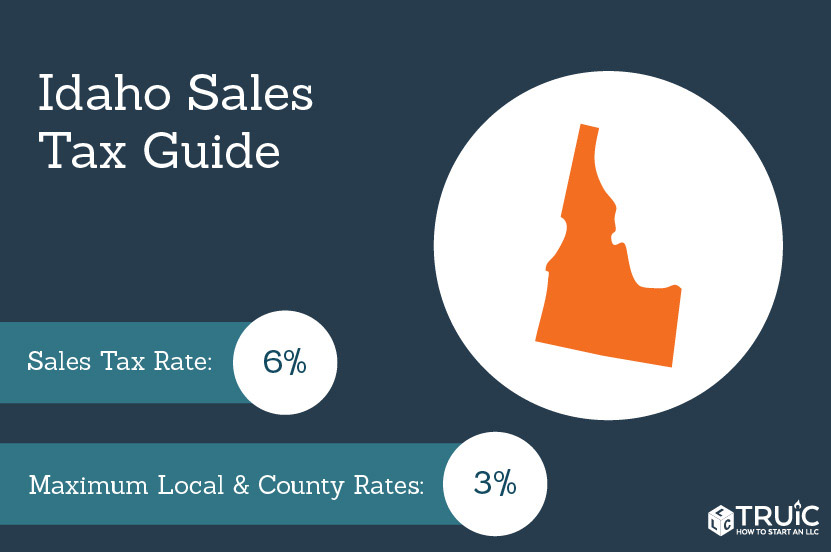

The commissioners office may be contacted by phone at 208-529-1360 or email at commseccobonnevilleidus. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

Idaho Sales Tax Guide And Calculator 2022 Taxjar

The total sales tax rate in any given location can be broken down into state county city.

. Idaho Falls ID Sales Tax Rate. 8 Bear Lake. Combined State and Average Local Sales Tax Rate.

Depending on local municipalities the total tax rate can be as high as 9. The County sales tax rate is. County tax rates range throughout the state.

To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801. The Kootenai County sales tax rate is. Let us know if you have difficulty accessing any of these documents.

6 rows Click any locality for a full breakdown of local property taxes or visit our Idaho sales. To review the rules in. Cash cashiers check money order personal or bank check.

The average combined tax rate is 603 ranking 37th in the. Idaho County Treasurer Tax Collector and Public Administrator 320 West Main St Rm 2 Grangeville Idaho 83530 Phone 208 983-2801 Fax 208 983-7774. The Idaho Falls sales tax rate is.

Sales Tax Rates in Major. Learn about Idaho tax rates rankings and more. Boise County Treasurer and Tax Department Office 420 Main Street Idaho City ID 83631 Phone 208 392-4441 Fax 208 392-9719.

To find detailed property tax statistics for any county in Idaho click the countys name in the data table above. Acceptable forms of payment are. Delinquent Taxes and Tax Sales.

Makes more than two retail sales during any 12-month period. The Mountain Home Idaho sales tax is 600 the same as the Idaho state sales tax. The current Idaho sales tax rate is 6.

This rate includes any state county city and local sales taxes. Total Sales Tax Rate. Has impacted many state nexus laws and sales tax collection requirements.

What is the sales tax rate in Idaho Falls Idaho. The use tax rate is the same as the sales tax rate. This is referred to in Idaho State Code as the Auditors Certificate.

Property will be deeded subject to bank. Reviewing Benefits of the State and Local Tax Deduction by County in 2018. Instead the dollars fund things like schools roads emergency services mosquito abatement and city and county government services.

All funds pass through the Treasurers office. The Idaho sales tax rate is currently. For a nationwide comparison of each states highest and lowest taxed counties see median property tax by state.

This is the total of state county and city sales tax rates. Sells to a consumer who wont resell or lease the product. A homeowner with a property in Boise worth 250000 would then pay 2003 for their annual property taxes.

Prescription Drugs are exempt from the Idaho sales tax. The Treasurers office is responsible for cross-checking all funds collected through the county which includes drivers license fees court fines auto license fees recording fees and any fee collected by any county department. Idaho County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by property tax collections.

The County sales tax rate is. A homeowner with the same home value of 250000 in Twin Falls Twin Falls County would be. Ammon ID Sales Tax Rate.

FUN FACTS Several Idaho resort cities and three auditorium community center that service public need and promote prosperity security and general welfare of the inhabitants of the district districts have a local sales tax imposed in addition to the state sales tax. None of those dollars are allocated to the State of Idaho unlike income or sales tax. NOTICE OF SALE OF COUNTY PROPERTY.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. The current Idaho sales tax rate is 6. A retailer is any individual business nonprofit organization or government agency that does any of the following.

Object Moved This document may be found here. The Idaho ID state sales tax rate is currently 6 ranking 16th-highest in the US. The original Idaho state sales tax rate was 3 it has since climbed to 6 as of October 2006.

Tax rates provided by Avalara are updated monthly. Payment in full is required the day of the sale. 56 rows Idaho County ID Sales Tax Rate.

For instance lets say you live in an area within Ada County that includes taxes owed to the City of Meridian and the. 37 Click for a. The minimum combined 2022 sales tax rate for Idaho Falls Idaho is.

The 2018 United States Supreme Court decision in South Dakota v. The median property tax also known as real estate tax in Idaho County is 73700 per year based on a median home value of 14090000 and a median effective property tax rate of 052 of property value. S Idaho State Sales Tax Rate 6 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality.

NOTICE IS HEREBY GIVEN that the Board of County Commissioners of Idaho County State of Idaho in compliance with Section 31-808 Idaho Code as amended will offer for sale at public auction in the Commissioners Meeting Room of the Idaho County Courthouse Grangeville Idaho to the highest bidder Tuesday September 21 2021 at. Explore data on Idahos income tax sales tax gas tax property tax and business taxes. Blackfoot ID Sales Tax Rate.

The average local rate is 003. No registration is required to attend the auction. The Idaho state sales tax rate is currently.

278 rows County Name Tax Rate.

Historical Idaho Tax Policy Information Ballotpedia

Food Scenes Livability Best Cities Best Places To Live Yellowstone

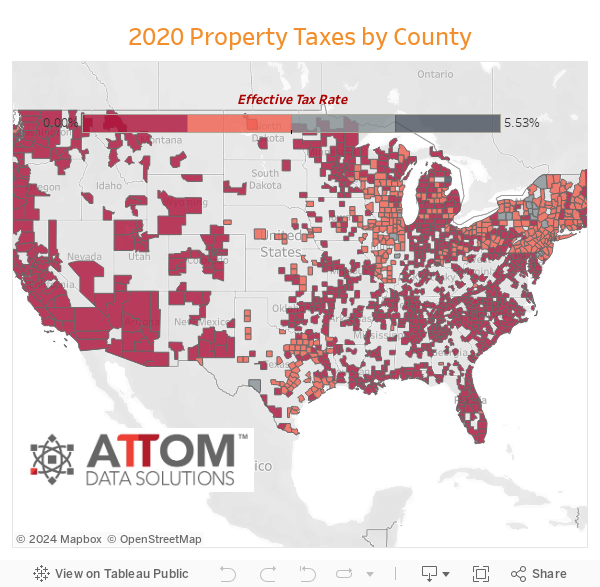

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Idaho Sales Tax Rates By City County 2022

Sales Tax By State Is Saas Taxable Taxjar

General Idaho Information Map Of Idaho Cities Idaho Adventure Idaho Travel Idaho Vacation

Idaho Sales Tax Small Business Guide Truic

State And Local Sales Taxes In 2012 Tax Foundation

States With Highest And Lowest Sales Tax Rates

Houses Property Tax What Is Property Idaho

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

The 10 Best And Worst States To Retire In 2017 Clark Howard Clark Howard Retirement Bankrate Com

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Pin By Graphicspedia On Funny United States Map United States History Map

Best States To Retired In With The Lowest Cost Of Living Gas Tax Federal Income Tax Income Tax

Claim Your Grocery Credit Refund Even If You Don T Earn Enough To File Income Taxes Idaho Bigcountrynewsconnection Com

Idaho Ranks 21st In The Annual State Business Tax Climate Index Stateimpact Idaho